Indonesia's Top Tin Firm Says New Export Rules Will Hinder S

Tin exports initially plunged after the rule was introduced.

Tin exports initially plunged after the rule was introduced.

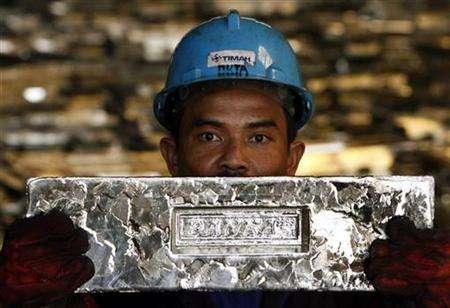

Bareksa.com - Changes to tin export rules due to come into effect in three months in top producer Indonesia will hurt shipments of the solder material, an official at the country's biggest tin company, PT Timah Tbk, said on Wednesday.

In a bid to halt illegal mining and give it greater control over prices, Indonesia one year ago forced all tin ingot shipments to trade via a local platform before being exported. Solder was exempted until January 2015.

Tin exports initially plunged after the rule was introduced, and following a sharp rise in solder exports, the government looked at ways to close any loopholes.

Promo Terbaru di Bareksa

Late last month, the trade ministry announced plans to distinctly categorise exporters of pure ingot, solder, pure non ingot and tin alloy from November 1 - which will force integrated tin miners to create separate subsidiaries and register for separate export licenses.

This may hinder supplies to the global tin market, an official at state-owned PT Timah said.

"It will reduce exports of tin ingot," Timah Corporate Secretary Agung Nugroho told Reuters. "It means one company, one (export) permit and one company per product."

Previously, Indonesian tin firms had to only register for one type of export licence, and given the notorious bureaucracy in Southeast Asia's biggest economy, delays cannot be ruled out.

Tin ingot sales by Timah, which halted exports for up to two weeks in July due to falling global benchmark prices, account for around 95 percent of the firm's total sales.

The amended regulation also raises the purity requirement for solder exports to 99.7 percent from 63 percent previously, and maintains the ingot purity requirement at 99.9 percent.

In May and June, Indonesia exported 25,155.60 tonnes of refined tin, higher than the previous four months combined.

Tin on the London Metal Exchange traded at $22,500 a tonne on Wednesday, and is little-changed so far this year. (Source : Reuters)

Pilihan Investasi di Bareksa

Klik produk untuk lihat lebih detail.

| Produk Eksklusif | Harga/Unit | 1 Bulan | 6 Bulan | YTD | 1 Tahun | 3 Tahun | 5 Tahun |

|---|---|---|---|---|---|---|---|

Trimegah Dana Tetap Syariah Kelas A | 1.385,6 | ||||||

Trimegah Dana Obligasi Nusantara | 1.095,56 | - | |||||

STAR Stable Amanah Sukuk autodebet | 1.085,51 | - | - | ||||

Capital Fixed Income Fund autodebet | 1.854,58 | ||||||

Insight Renewable Energy Fund | 2.288,82 |

Produk Belum Tersedia

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.

Produk Belum Tersedia

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.