Asian shares retreat, oil near 3-month high on Iraq concerns

Japan's Nikkei share average led the retreat, falling 0.8 percent

Japan's Nikkei share average led the retreat, falling 0.8 percent

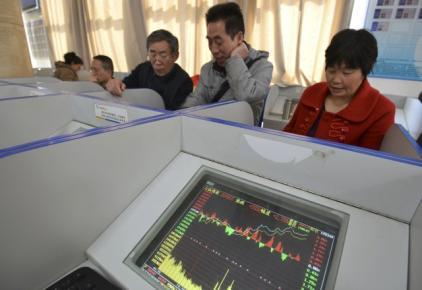

Bareksa.com - Asian shares slipped on Thursday after Wall Street shares stepped back from record levels, while growing violence in Iraq supported oil prices.

Japan's Nikkei share average led the retreat, falling 0.8 percent while MSCI's broadest index of Asia-Pacific shares outside Japan dipped 0.4 percent.

The S&P 500 lost 0.35 percent to 1,943.89, its first significant loss in about three weeks. As recently as Monday it hit a record closing high of 1,951.27.

Promo Terbaru di Bareksa

"I think it was just natural profit-taking after the strong rally we have seen so far. I continue to expect the world's shares to remain solid," said Kensaburo Suwa, senior strategist at Okasan Securities.

Some market players said a lower global growth forecast from the World Bank was being used as grounds to sell while others said fighting in Iraq may have sapped investor appetite.

Adding to the sour tone, a surprise primary defeat of the second-ranking U.S. House Republican, Eric Cantor, by a Tea Party candidate in primary stoked worries of a possible return of acrimonious budget fights that in the past have caused government shutdowns.

Oil prices also stayed near recent peaks as fighting in Iraq prompted worries about the supply outlook.

Militants from an al-Qaeda splinter group captured Mosul, the country's second largest city, and closed in on the biggest oil refinery in Iraq.

U.S. crude futures were up 0.2 percent at $104.62 per barrel, near a three-month high of $105.06 hit on Tuesday.

The insurgency has also hurt financial markets in Turkey, where stocks fell 3.3 percent and the lira tumbled 1.7 percent on Wednesday as the militants took 80 Turkish nationals as hostage.

Among major currencies, the New Zealand dollar jumped more than 1 percent after the country's central bank raised interest rates and retained a hawkish bias, surprising some investors who had bet on a slower pace of rate hikes.

The kiwi hit a three-week high of $0.8651 and last traded at $0.8643.

Other major currencies were little changed with the euro still stuck near the four-month low hit after the European Central Bank cut rates last week.

The euro traded at $1.3540, compared to low of $1.3503 hit on Thursday. The yen traded at 101.99 yen to the dollar, after hitting one-week high of 101.86.

U.S. debt yields rose slightly, with the 10-year yield hitting a one-month high of 2.662 percent after a disappointing Treasury auction. It last stood at 2.642 percent.

Palladium was firm near a 13-year high hit the previous day on supply worries from a five-month-long miners' strike in South Africa.

It has gained 20 percent so far this year after the crisis in Ukraine raised concerns on supply from Russia, the world's largest producer. (Source : Reuters)

Pilihan Investasi di Bareksa

Klik produk untuk lihat lebih detail.

| Produk Eksklusif | Harga/Unit | 1 Bulan | 6 Bulan | YTD | 1 Tahun | 3 Tahun | 5 Tahun |

|---|---|---|---|---|---|---|---|

Trimegah Dana Tetap Syariah Kelas A | 1.384,88 | ||||||

Trimegah Dana Obligasi Nusantara | 1.095,38 | - | |||||

STAR Stable Amanah Sukuk autodebet | 1.084,98 | - | - | ||||

Capital Fixed Income Fund autodebet | 1.853,59 | ||||||

Insight Renewable Energy Fund | 2.287,69 |

Produk Belum Tersedia

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.

Produk Belum Tersedia

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.