Apa yang mau kamu cari?

Kamu bisa mulai dari nama produk investasi atau topik tertentu.

Kamu bisa mulai dari nama produk investasi atau topik tertentu.

Multinationals may shift/diversify into other ASEAN countries

Multinationals may shift/diversify into other ASEAN countries

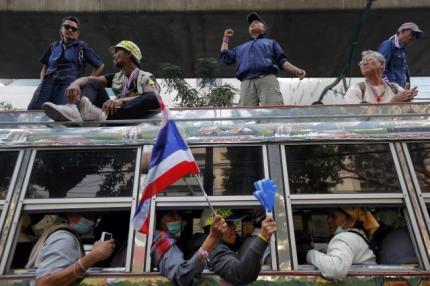

Reuters - Long-term foreign investors say they are sticking with Thailand despite its political woes but the threat of worsening chaos may scare away new money as companies scope out other options in neighbouring countries such as Indonesia.

Protesters trying to topple the government have rallied in the capital, Bangkok, since November. This month they have forced ministries to close and blocked major roads. They say they will stop a general election being held on Feb. 2.

"Assuming the political woes go on, foreign investors may decide to shift to other countries like Indonesia, Vietnam and Myanmar," Kyoichi Tanada, president of Toyota Motor Corp's Thai unit, said this week.

"Many investors want to invest in Thailand. If the situation has not been resolved, the ones which are already invested may not go away, but whether they will invest more, it's questionable," said Tanada, also vice-president of the Japanese Chamber of Commerce, which represents 1,524 Japanese firms in the Southeast Asian country.

Thailand gets more than half of its foreign direct investment from Japan. That foreign capital brings much-needed money into a country that recorded a current account deficit in 2013 and may again this year.

It is the biggest car market in Southeast Asia and a regional production and export base for top manufacturers such as Toyota, Nissan Motor Co and Ford Motor Co.

It is also a major global production centre for hard disk drives with big players such as Seagate Technology and Western Digital having operations in the country.

Thai partners are putting a brave face on things.

Hemaraj Land and Development runs seven big industrial estates, home to factories for the likes of Ford Motor, General Motors and Caterpillar.

David Nardone, its chief executive, said 10-20 percent of new customers had postponed signing contracts to take up facilities since December.

"It's short-term disruption," Nardone said, hopeful there would be a recovery in the next few months. "There may be some people who don't know Thailand so well and they may take longer, have more questions and wait for clarity."

The optimists point to 2010, when more than 90 people died in another protracted bout of political unrest. Foreign direct investment jumped 88 percent that year, the stock market surged 41 percent and the economy bounded ahead by 7.8 percent.

This time, however, the protests have gone on for three months and government work is being disrupted.

Some $60 billion of infrastructure spending may not get started this year, for example. Consumer confidence fell for the ninth month in December to a two-year low and investors worry about a possible escalation of violence, which will hold back Southeast Asia's second-largest economy after Indonesia.

POLITICS AND FLOODS

"Political instability is always preventing investment flows. Long term investments projects may be reconsidered and other locations may be reassessed," said Rolf-Dieter Daniel, President of the European ASEAN Business Centre, which groups 14 European chambers of commerce in Thailand.

Foreign direct investment probably totalled almost $13 billion in 2013 but could drop to less than $8 billion in 2014 even if tension eased and investors returned in the second half, said Pimonwan Mahujchariyawong, an economist at Kasikorn Research Center in Bangkok.

Investment also dropped in 2011 when widespread flooding disrupted the activities of global electronics and car firms.

"Multinational firms tend to diversify their investments to other ASEAN countries as well, to reduce risks (either from politics or disasters)," Pimonwan said, adding FDI could return to a more normal $8-9 billion per annum in the next 3-5 years.

Economists say Thailand's fundamentals - a relatively large market of around 67 million people, a growing middle class, pro-business environment, good infrastructure and geographical advantages including access to emerging markets such as Myanmar - helped it stand out in Southeast Asia and attract investment.

Jongkie D. Sugiarto, chairman of the Association of Indonesia Automotive Industries (Gaikindo), said Indonesia with its 240 million people was well placed to catch up.

But the regulatory environment had to be improved and the domestic market developed, he said. "We also have to build our infrastructure, from ports to the provision of electricity and gas, roads and so on. How can we possibly ask car companies that want to invest in Indonesia to build power plants first?"

This year was always going to be tough for Thailand.

"Lacklustre exports and weak consumer spending from 2013 have resulted in low average capacity utilisation at around 64 percent and high growth of inventory accumulation," said Sutapa Amornvivat, chief economist at Siam Commercial Bank, expecting private investment growth of about 3 percent in 2014, much lower than the average 10-year rate of 6 percent.

"But, looking beyond 2014, we think Thailand still makes a very good long-term bet," she said.

That sentiment was echoed by Honda Automobile (Thailand), part of Honda Motor.

"New potential investors may be spooked by the political woes," said Pitak Pruittisarikorn, its executive vice-president. "For Honda, we have been in Thailand for more than 50 years and we are still confident in Thailand's long-term outlook."

Klik produk untuk lihat lebih detail.

| Produk Eksklusif | Harga/Unit | 1 Bulan | 6 Bulan | YTD | 1 Tahun | 3 Tahun | 5 Tahun |

|---|---|---|---|---|---|---|---|

Trimegah Dana Obligasi Nusantara autodebet | 1.118,19 | - | |||||

STAR Stable Amanah Sukuk autodebet | 1.108,24 | - | - | ||||

Capital Fixed Income Fund autodebet | 1.890,88 | ||||||

Syailendra Sharia Fixed Income Fund | 1.083,22 | - | - | ||||

Capital Regular Income Fund Dividen | 1.027,3 | - | - | - | - |

ST014T2

Syariahsukuk tabungan

Imbal Hasil/Th

6,5%

Periode Pembelian

Berakhir dalam 8 hari

Jangka Waktu

2 tahun

Terjual 95%

ST014T4

Syariahsukuk tabungan

Imbal Hasil/Th

6,6%

Periode Pembelian

Berakhir dalam 8 hari

Jangka Waktu

4 tahun

Terjual 72%

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.