Apa yang mau kamu cari?

Kamu bisa mulai dari nama produk investasi atau topik tertentu.

Kamu bisa mulai dari nama produk investasi atau topik tertentu.

Meanwhile , the cement sector has outperformed the market due to its perceived status as an infrastructure beneficiary.

Meanwhile , the cement sector has outperformed the market due to its perceived status as an infrastructure beneficiary.

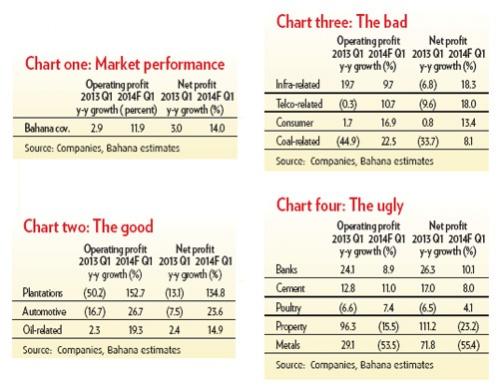

The Jakarta Post - As the Jakarta Composite Index (JCI) has been one of the best-performing markets in the region year-to-date (ytd), we think corporate earnings will become an important determinant for stock-price movements. In our coverage universe (chart one), we expect operating-profit growth in the first quarter (Q1) of 2014 to accelerate to 11.9 percent year-on-year (y-y) from 2.9 percent y-y in 2013 Q1.

On the bottom line, we project 2014 Q1 net profit growth to rise to 14 percent y-y from 3 percent y-y in 2013 Q1. We think solid growth in 2014 Q1 would help support the Indonesian market’s recent strong performance and we retain our year-end 5,000 index target.

Klik produk untuk lihat lebih detail.

| Produk Eksklusif | Harga/Unit | 1 Bulan | 6 Bulan | YTD | 1 Tahun | 3 Tahun | 5 Tahun |

|---|---|---|---|---|---|---|---|

Trimegah Dana Obligasi Nusantara autodebet | 1.121,74 | - | |||||

STAR Stable Amanah Sukuk autodebet | 1.109,93 | - | - | ||||

Capital Fixed Income Fund autodebet | 1.893,98 | ||||||

Syailendra Sharia Fixed Income Fund | 1.085,28 | - | - | ||||

Capital Regular Income Fund Dividen | 1.028,98 | - | - | - | - |

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.

SR022

SyariahSukuk Ritel

Periode Pembelian

16 Mei - 18 Jun 2025

Tipe Kupon

Fixed

SBR014

Saving Bond Ritel

Periode Pembelian

14 Jul - 7 Agt 2025

Tipe Kupon

Mengambang

SR023

SyariahSukuk Ritel

Periode Pembelian

22 Agt - 12 Sep 2025

Tipe Kupon

Fixed

ORI028

Obligasi Negara Ritel

Periode Pembelian

29 Sep - 23 Okt 2025

Tipe Kupon

Fixed

ST015

SyariahSukuk Tabungan

Periode Pembelian

10 Nov - 3 Des 2025

Tipe Kupon

Mengambang