Apa yang mau kamu cari?

Kamu bisa mulai dari nama produk investasi atau topik tertentu.

Kamu bisa mulai dari nama produk investasi atau topik tertentu.

Statements by President Joko Widodo and ministers indicate a priority will be resolving land acquisition problems

Statements by President Joko Widodo and ministers indicate a priority will be resolving land acquisition problems

Bareksa.com - Indonesia's new government is launching a bid to convince sceptical foreign investors to pour billions of dollars into improving the country's dilapidated infrastructure, promising to reduce corruption and bureaucracy.

Entrenched graft, burdensome red tape and confusing regulations have scared off investors at a time when disarray in the sprawling country's infrastructure is a major obstacle to economic growth - which has been slowing.

Statements by President Joko Widodo and ministers indicate a priority will be resolving land acquisition problems, long a big obstacle to infrastructure improvement.

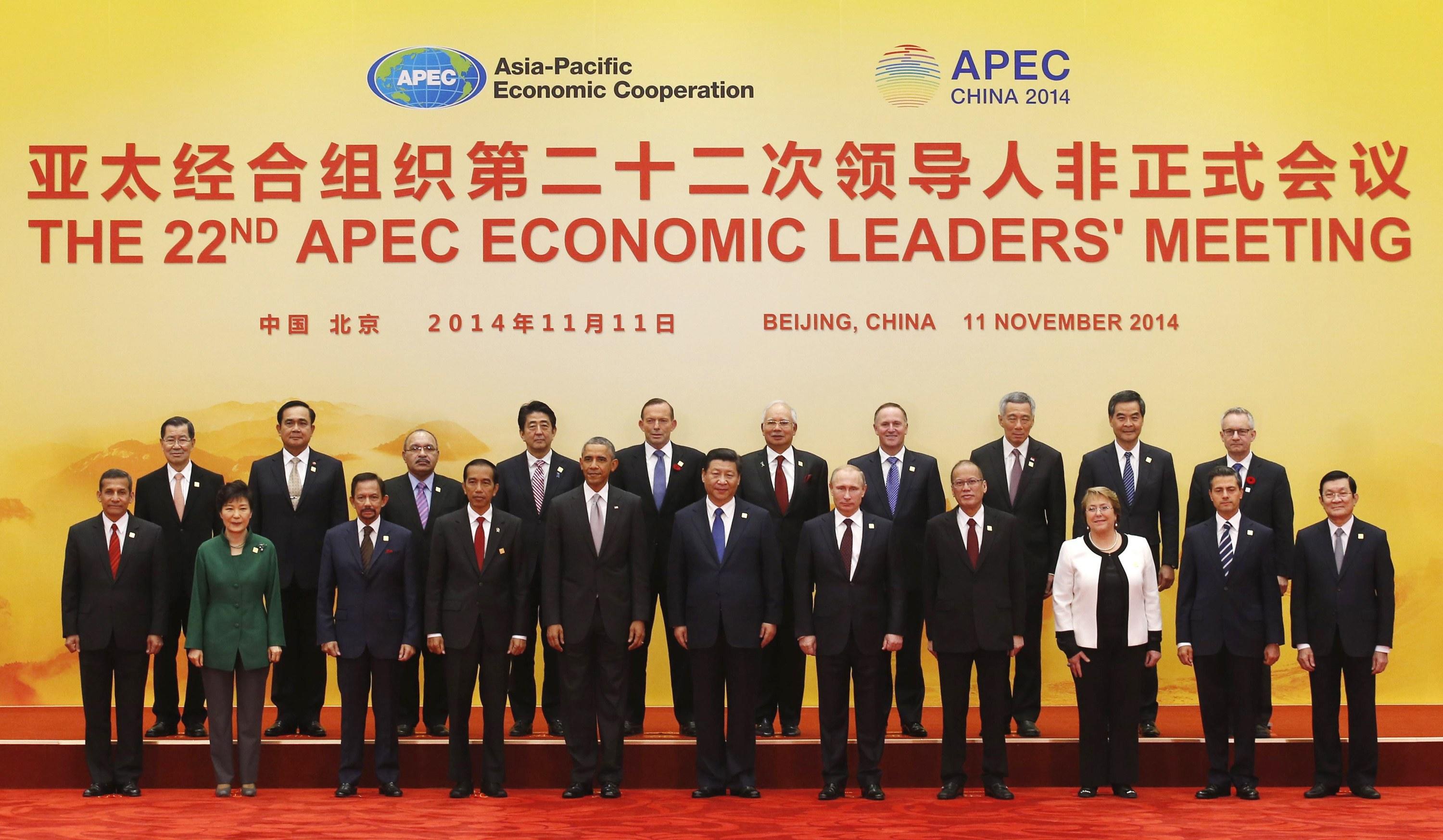

"A lot of investors, when they come to me, they always complain about land acquisition," Widodo on Monday told chief executives in Beijing for the Asia-Pacific Economic Cooperation (APEC) summit.

"I will push my ministers, my governors, my mayors to help clear this problem," he said.

Widodo, who started a five-year term on Oct. 20, used his first foreign trip to try to repair Indonesia's poor reputation, inviting global CEOs to invest in Indonesia's ports, power plants, roads and railways.

"I was a businessman ... I'm very happy because we can talk about business, about investment with all of you," Widodo said.

Andrinof Chaniago, head of Indonesia's national development planning agency, told Reuters that under its five-year infrastructure plan, Widodo's government wants to build many ports, 25 dams, 10 airports, 10 industrial parks and 2,000 kilometres (1,250 miles) of roads.

Indonesia needs at least 6,000 trillion rupiah ($493.4 billion) in infrastructure investment over five years, according to Bastary Pandji Indra, director of the agency's public-private partnership development.

Widodo's signature project is to build 24 small feeder ports and five deep-sea ones. More than half of the estimated $5.75 billion cost should come from private firms, said Coordinating Minister for Maritime Affairs Indroyono Soesilo.

Companies, however, want to see major reforms before investing.

Ports "are really big investments so there needs to be openness about designs and also the whole tender process needs to be more transparent and simplified," said Jakob Sorensen, chief executive of the Indonesia unit of shipping firm AP Moeller Maersk A/S.

Building ports could be hindered by land-title issues that have stymied construction of power plants.

In July, a joint venture between Japan's Itochu Corp , Electric Power Development Co Ltd and Indonesia's Adaro Energy Tbk declared force majeure on a $4 billion project in Central Java due to a land acquisition problem.

FIXING THE PROBLEMS

Last week, Widodo pitched infrastructure opportunities to a group of global institutional investors who manage a combined $8 trillion.

His presentation included a photo of him sitting with residents who long refused to sell their land, blocking completion of a Jakarta road project. Widodo, then Jakarta governor, got the residents to sell, and the project was completed.

"That's the sort of concrete deliverable that investors really appreciate. He gets down into the field himself to help resolve the situation," said Tom Lembong, chief executive of Quvat Management, a Singapore-based private equity firm that invests in Indonesia.

"Jokowi is a huge magnet for investors," Lembong said. "He speaks the language of business."

The Widodo administration aims to create a "one-stop shop" to slash the time needed to get investment permits to 15 days, instead of a multi-stop process taking up to three years, Chaniago said. It may also offer tax incentives for strategic sectors such as renewable energy.

If Indonesia doesn't attract enough private investment, it could consider the new China-based $50-billion Asian Infrastructure Investment Bank (AIIB) as a source, Soesilo said.

Indonesia hasn't decided whether to join AIIB, seen as challenging the Western-dominated World Bank and Asian Development Bank. (Source : Reuters)

Klik produk untuk lihat lebih detail.

| Produk Eksklusif | Harga/Unit | 1 Bulan | 6 Bulan | YTD | 1 Tahun | 3 Tahun | 5 Tahun |

|---|---|---|---|---|---|---|---|

Trimegah Dana Obligasi Nusantara autodebet | 1.118,69 | - | |||||

STAR Stable Amanah Sukuk autodebet | 1.108,79 | - | - | ||||

Capital Fixed Income Fund autodebet | 1.891,91 | ||||||

Syailendra Sharia Fixed Income Fund | 1.083,87 | - | - | ||||

Capital Regular Income Fund Dividen | 1.027,86 | - | - | - | - |

ST014T2

Syariahsukuk tabungan

Imbal Hasil/Th

6,5%

Periode Pembelian

Berakhir dalam 4 hari

Jangka Waktu

2 tahun

Terjual 95%

ST014T4

Syariahsukuk tabungan

Imbal Hasil/Th

6,6%

Periode Pembelian

Berakhir dalam 4 hari

Jangka Waktu

4 tahun

Terjual 86%

Ayo daftar Bareksa SBN sekarang untuk bertransaksi ketika periode pembelian dibuka.