Indonesian Tin Trades Slow to a Trickle as Global Prices Fal

Bareksa • 15 Sep 2014

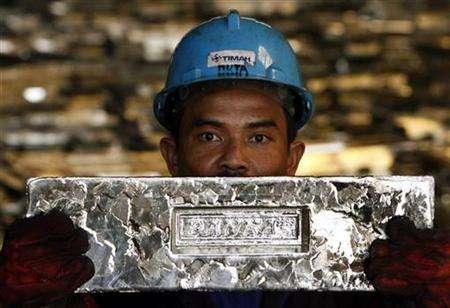

Pekerja PT Timah menunjukkan timah batangan (Reuters/Lewa pardomuan)

Our view that the tin market would be in supply deficit in 2014 for the fifth consecutive year is in question

Bareksa.com - Indonesian tin sellers are refraining from trading the metal on the country's sole physical trading platform due to a sharp recent drop in global prices, in a move that will hurt shipments from the world's top tin exporting nation.

The Southeast Asian nation has, for a year now, required all tin ingot shipments to trade via the Indonesia Commodity and Derivatives Exchange (ICDX) before being exported. But a near 10 percent drop in global tin prices over the past five weeks has taken them below a reference price and made trades unprofitable.

As a result, most traders are pulling back. Indonesian tin sellers have traded just 150 tonnes across the ICDX's five physical tin contracts in September so far, according to Reuters calculations. The last trade on the most used contract was at $21,960 a tonne.

In the first seven months of 2014, just over 33,000 tonnes of tin were traded on ICDX, according to data from the bourse.

A drop in trades means exports, which will be entering a seasonal lull in the coming months due to the monsoons in Indonesia, will face additional pressure, which could potentially support London Metal Exchange (LME) prices.

Jabin Sufianto, president of the Indonesian Association of Tin Exporters (AETI), which includes 18 out of the 22 tin smelters registered to sell on the ICDX, told Reuters the association's members have stopped selling on the exchange since end-August.

Sufianto said global prices needed to be about $22,500 a tonne before they would resume sales. LME tin prices hit a 13-month low of $20,875 a tonne this week.

"There is not much coming out of Indonesia right now," said a tin trader based in China. "There is not much tin ore or concentrates available and there is also poor liquidity on the ICDX due to price differential with the LME."

Officials at ICDX were unable to give an immediate comment on Friday, while the country's biggest tin company, PT Timah Tbk , which is not a member of the AETI, could not be reached for comment.

In addition to the onset of the monsoon season, from November 1, the Indonesian government is set to introduce further changes to export rules that exporters say will hurt shipments of the solder material.

Indonesia's regulation shift was largely expected to result in a deficit this year, underpinning global prices, but so far supply has surpassed expectations while demand from the electronics industry has been feeble.

"Our view that the tin market would be in supply deficit in 2014 for the fifth consecutive year is in question. It would appear both that tin demand has been weaker and that supply has been firmer than we expected," said BNP Paribas in a note.

"Nevertheless ... we still conclude that tin will be in a (small) deficit over 2014 as a whole, with a rather larger deficit in 2015 ... We continue to target $25,000/t, although this may now not be reached until well into 2015 and $27,000/t may no longer be achievable within our forecast time horizon."

Indonesia's trade ministry is expected to release its August export data for tin in the coming days.

Southeast Asia's biggest economy exported 91,612.75 tonnes of refined tin last year, and from January until July it shipped 49,116.96 tonnes. (Source : Reuters)