Analysis : 1Q14 result preview : The good, the bad and the

Bareksa • 25 Apr 2014

As the Jakarta Composite Index (JCI) has been one of the best-performing markets in the region year-to-date (ytd) - (The Jakarta Post)

Meanwhile , the cement sector has outperformed the market due to its perceived status as an infrastructure beneficiary.

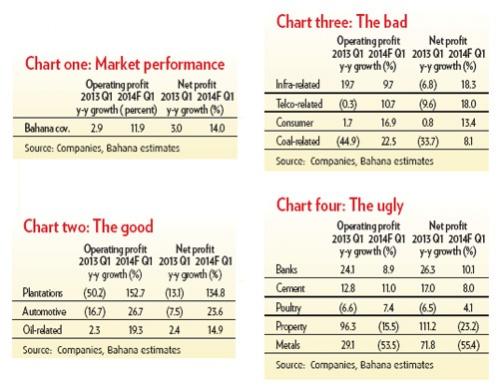

The Jakarta Post - As the Jakarta Composite Index (JCI) has been one of the best-performing markets in the region year-to-date (ytd), we think corporate earnings will become an important determinant for stock-price movements. In our coverage universe (chart one), we expect operating-profit growth in the first quarter (Q1) of 2014 to accelerate to 11.9 percent year-on-year (y-y) from 2.9 percent y-y in 2013 Q1.

On the bottom line, we project 2014 Q1 net profit growth to rise to 14 percent y-y from 3 percent y-y in 2013 Q1. We think solid growth in 2014 Q1 would help support the Indonesian market’s recent strong performance and we retain our year-end 5,000 index target.