China set to boost tin exports as traders eye arbitrage wind

Bareksa • 07 Apr 2014

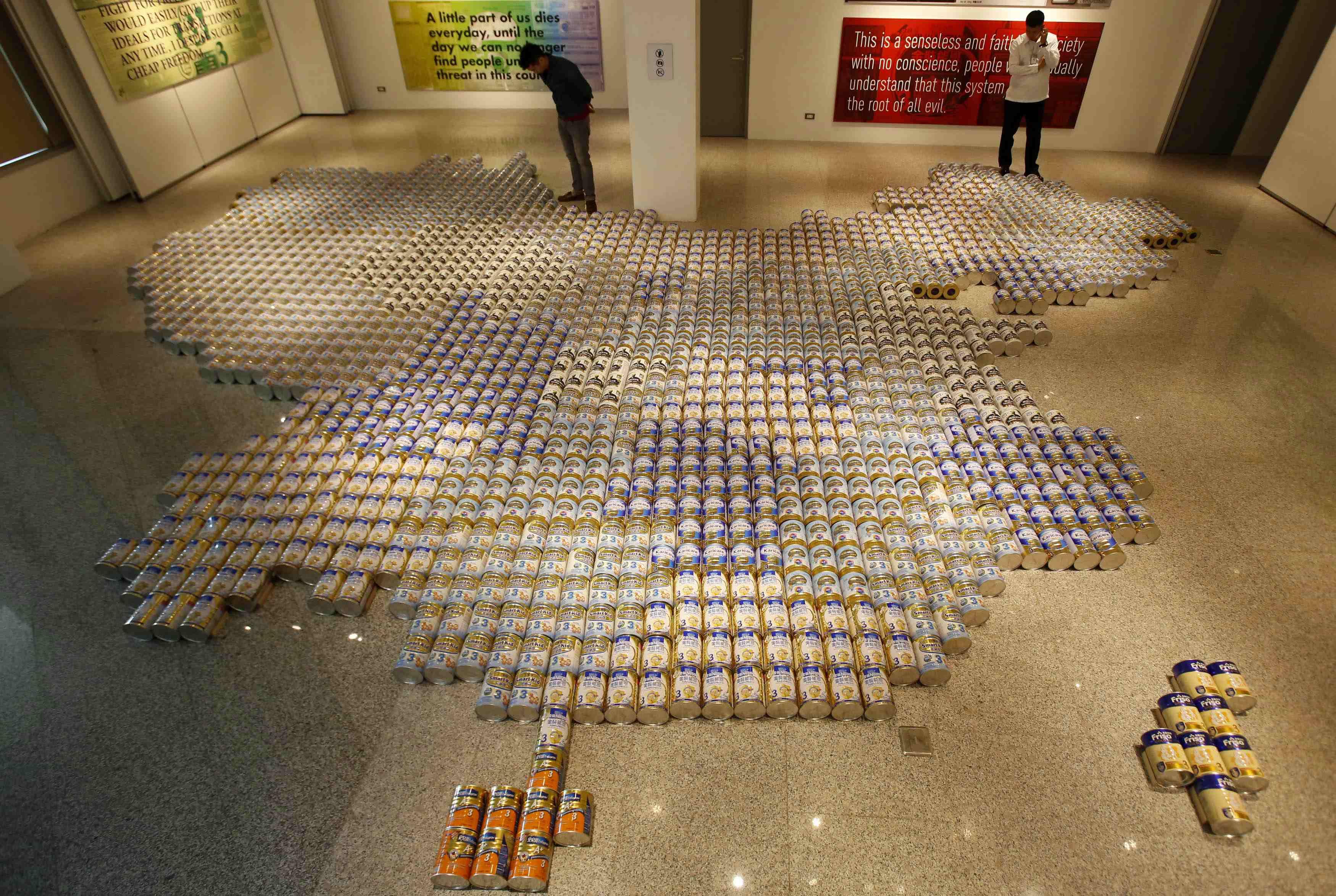

The art piece consists of 1,815 tin cans of seven popular baby formula milk brands arranged to form the map of China, which represents the artist's reaction to the issue of milk safety in China. -(REUTERS/Romeo Ranoco)

Analysts expect the global tin market to remain in deficit again this year, supporting global prices

Reuters - Indonesian curbs on tin exports are offering a prop to Chinese producers facing slumping demand at home, underpinning global prices and boosting the opportunity to ramp up overseas sales.

Tin prices in China have slipped below the London Metal Exchange (LME) price for the first time in three years, as a rise in the international benchmark has outpaced local prices.

While Chinese producers still face a 10 percent export tax, the current price gap will make some exports possible and further LME price rises will open an arbitrage window for increased sales from China, say traders and analysts.

"Producers are actively looking," said a trader at a bank in China. "If (prices) stay at current levels and demand picks up, you may see a couple of big names in China starting to ship out."

China is the world's biggest producer of tin and is also a major importer of the metal used primarily in solder for electronics.

Speculation that China producers could step up exports has been growing since Indonesia tightened control over its sprawling tin industry last year, part of a wider drive to earn more from mining by encouraging processing within the country.

Jakarta has forced domestic smelters to produce higher purity tin before export, and also made tin producers trade via a domestic exchange before shipping material for export.

Monthly tin exports have fallen by a third, pushing consumers to draw from London Metal Exchange stocks, which hit five-year lows near 8,000 tonnes in late February.

Analysts expect the global tin market to remain in deficit again this year, supporting global prices. <MSNSTX-TOTAL>

"The tin market is facing a deficit for the fifth year in a row. If Indonesia exports less ... one of the ways you fill that is Chinese exports," said analyst Stephen Briggs of BNP Paribas in London.

Briggs said he expected Chinese exports to easily eclipse last year's total of 3,000 tonnes, as long as the gap between global and local prices stayed profitable.

EXPORT OPPORTUNITY?

China, home to the world's largest tin producer Yunnan Tin Co Ltd, exported just 98 tonnes of tin in January and February, according to official trade data.

But shipments are expected to grow in March after the LME prices rose above domestic prices - excluding the 10 percent export tax.

Traders said Chinese producers could find ways to avoid the export tax by shipping tin in forms other than ingot or through other regulations relating to processing.

"If there is demand for that material, then that material might go out in a different form or shape that is allowed by the customs," the China-based trader said.

China also exempts some producers from paying export duties on refined metal if they have imported concentrate, to help offset the difference with global prices.

Three-month tin on the LME closed at $23,150 a tonne on Friday, taking its rise so far this year to 3.6 percent. This compares to 138,750 yuan ($22,300) a tonne for physical tin in China <SN-1-SHMET> before export taxes.

If Chinese prices hold steady, LME tin prices would need to climb to around $24,500 a tonne to attract exports in scale. Barclays sees tin prices at $25,500 this quarter, climbing to $27,000 by year end.

Traders said demand for tin has softened given China's slowing growth, while producers are yet to see any improvement in orders from Europe or the United States.

"Demand is really weak. The Chinese are not doing anything," said a third trader who buys Indonesian material and ships it to China.

Chinese imports slumped 78 percent in February from a year earlier to a 10-year low of just 261 tonnes, according to trade data.

Manufacturing in Asia and Europe finished the first quarter on a weaker note but U.S. activity remained relatively steady, suggesting severe winter weather in North America had only a modest effect on U.S. factories.

Traders hope an uptick in demand will spur selling by Chinese producers.

"I've been asking my guy in Shanghai to keep an eye out if there is somebody willing, but nothing has happened so far," said a physical metals trader in Asia.